Article Directory

AI Bubble Trouble? Why This Isn't 2000 (and Why You Should Still Be Excited)

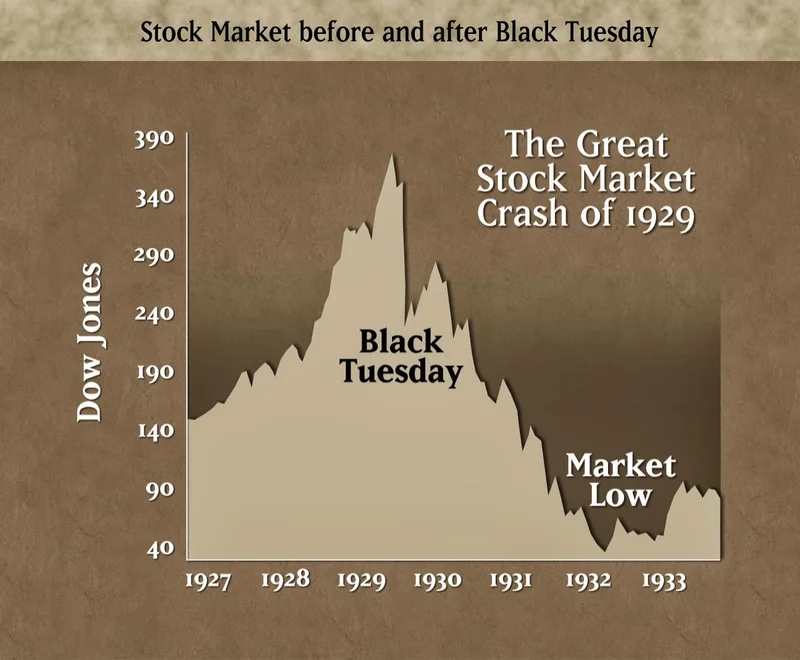

Okay, let's talk about the elephant in the room: the stock market. Everyone's whispering about a bubble, especially with AI stocks going stratospheric. You see headlines screaming "Stock Market Bubble Burst Imminent!" and analysts drawing parallels to the dot-com crash. I get it. The S&P 500's Cyclically Adjusted Price Earnings Ratio is hovering around 40, and Warren Buffett's favorite market-to-GDP ratio is flashing warning signs – higher even than in 2000! OpenAI is valued at half a trillion dollars despite not turning a profit, and the "Magnificent Seven" AI players make up over a third of the S&P 500. It's enough to make anyone nervous, right?

But here's where I think we need to pump the brakes on the doom and gloom. Yes, there are similarities to past bubbles, but this time it's different. And this difference is why I'm still incredibly optimistic about the future. Bridgewater's Ray Dalio says not to sell just because of a bubble. I agree.

It's About More Than Just Money

See, everyone's focused on the money being thrown at AI. Hundreds of billions poured in, supposedly accounting for half of US GDP growth recently. Sure, that sounds unsustainable. But what if we stopped thinking about it as just money, and started seeing it as fuel? Fuel for a technological revolution, a paradigm shift that's going to change everything? The dot-com bubble was about websites; this is about intelligence.

And that, my friends, is a game-changer.

The key difference is the potential of AI. The internet connected information; AI is poised to connect intelligence to every aspect of our lives. Think about it: personalized medicine, sustainable energy solutions, education tailored to each individual student. This isn't just about making rich people richer; it's about solving some of humanity's biggest problems. It's about building a better future for everyone.

I saw a comment on a Reddit thread the other day that really resonated with me: "AI isn't just another tech fad; it's a fundamental shift in how we create and solve problems." Exactly! That's what people need to understand.

Now, is there a risk of a correction? Absolutely. As the When Will the Stock Market Bubble Burst? points out, even without the Fed tightening, external shocks like a pandemic or unexpected policy shifts (remember Trump's tariff announcement?) can send the market reeling. And the US's ballooning debt – potentially reaching 128% of GDP by 2030, according to the IMF – is a legitimate concern. An "overly accommodative" Fed, as the original article puts it, could spook the bond market and send long-term interest rates soaring, pricking the bubble.

But here's the thing: even if the market takes a hit, the underlying technology isn't going anywhere. The AI revolution will continue, driven by brilliant minds and fueled by the potential to create a better world.

A key point that the conventional wisdom overlooks is that it is the 10-year Treasury bond yield rather than the Fed’s short-term interest rate that is the most relevant both for the economy’s performance and for discounting a company’s earnings stream for valuation purposes. This means that if aggressive cuts in the Fed’s interest rate cause the long-term bond market yields to spike, that could be a trigger for the bursting of the stock market bubble.

Think of it like this: imagine the California Gold Rush. Sure, many prospectors went bust, but the gold remained, transforming the entire state and the nation. AI is our new "gold," and even if the initial rush fades, the long-term value is undeniable.

Of course, we need to be responsible. We need to address the ethical implications of AI, ensure fair access, and prevent misuse. This is a powerful tool, and like any powerful tool, it can be used for good or ill. But that's precisely why we need to stay engaged, to shape its development, and to ensure that it benefits all of humanity.